When it comes to protecting your assets, one of the most important things you can insure is your ability to work and earn a living with Disability Insurance.

With disability coverage you can continue to pay your bills and keep from going into serious debt.

If you were to ask yourself, “What the longest vacation I’ve ever taken?”, you’re probably right there with most people at two weeks. The reason is that the average person cannot go without income for more than two weeks. This is where disability coverage can help when the unexpected happens. If the average person cannot make it more than two weeks unpaid, why go months without any income, neglecting bills or payments, when disability insurance can help you?

Life does not stop when you are disabled and cannot work.

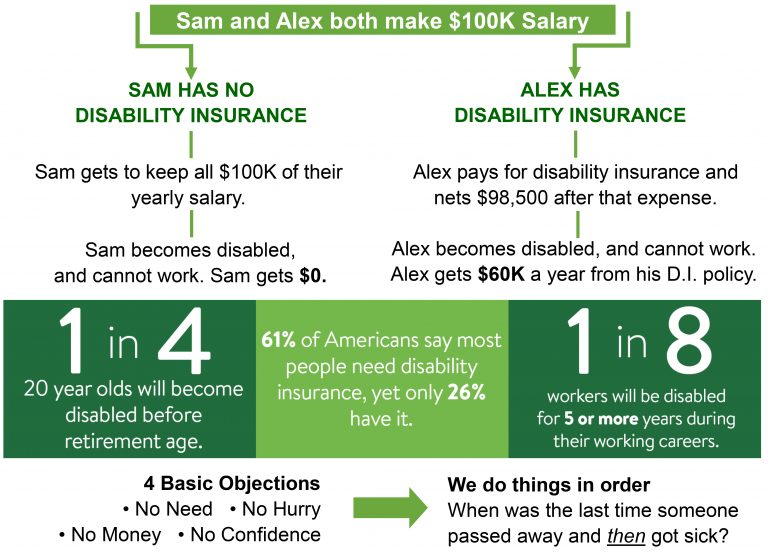

While you might not get you full salary, you will be covered. Here is an example of how it works:

Disability Insurance can help pay for other expenses while you are unable to work. Investments like health insurance, retirement, health expenses and college funds are just some of the life expenditures you might have to keep up with.

Want to know how much Disability Coverage you need?

Here is a document to help you figure that out: Disability Insurance Calculator

Know Your Benefits

What Is Long-term Disability Insurance (LTD)?

LTD is a type of disability insurance coverage that pays employees a set percentage of their regular income after a specified waiting period. For example, if a worker is covered under short-term

disability (STD) insurance as well, the LTD insurance would kick in once the STD policy is

exhausted, typically after three to six months.

LTD insurance protects workers in the event they become disabled for a prolonged period prior to retirement. LTD policies are often offered through employers as part of a standard benefits package.

The length of LTD plans varies; some may be limited to a period between two and 10 years, while other plans continue paying out until age 65.

What Is Short-term Disability Insurance (STD)?

STD is a type of disability insurance coverage that can help you remain financially stable should you become injured or ill and cannot work. Usually, STD coverage begins within one to 15 days of the event causing your disability. The coverage allows you to continue to receive pay at a fixed weekly amount or a set percentage of your income.

STD typically lasts for about 10 to 26 weeks, although this varies by policy. When this STD coverage ends, long-term disability (LTD) coverage typically takes effect.

Nearly one-third of employees will miss more than one month of pay due to injury or illness.

What Is Supplemental Disability Insurance?

Traditional medical insurance doesn’t cover every expense related to an injury or illness. Bills and

expenses can continue to add up, especially if you have to stop working and lose your income.

Why Is Disability Coverage So Important?

The risk of disability is greater than most employees realize. Your source of income is eliminated when you become disabled and lose time at work. In addition to lost income, you are most likely

experiencing an increase in medical expenses to deal with your disabling injury or illness.

If you have any more questions about disability insurance or any insurance topic feel free to call us or visit our website for more information.

https://www.gnadeinsurance.com/personal/disability-insurance/